Insights

Start investing early and let compounding do the magic for you.

Financial independence is the ultimate dream of every person. It seems really cool when you don’t have to depend on anyone to pay your bills. Generally, financial independence is a fruit that ripens when a person starts earning or is an adult. Given the dynamic environment and fast-changing world, financial independence is no longer an adult life dream...

Celebrating financial freedom for women!!!

Freedom can be translated into numerous dimensions which can mean different for everyone. For a few it can mean going out in a park without a leash around their neck, for few it can mean freedom from judgement because of gender; for few it means the liberty to buy whatever they want, not because they can’t afford it, but because they don’t have to ask someone else to buy it for them. This Independence Day apart from celebrating sovereignty and freedom of our country let’s also celebrate economic independence...

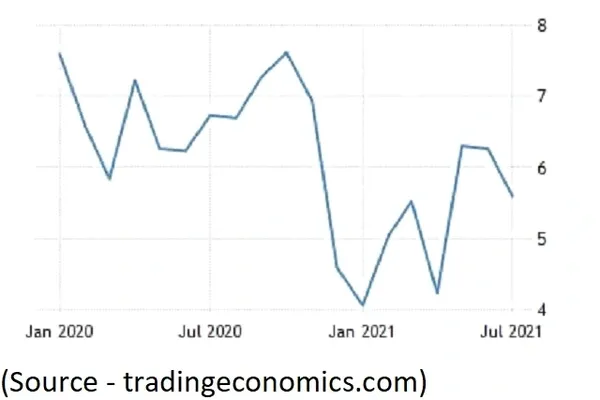

Cooling retail inflation, is it transitory or a real easing?

Indian consumers can breathe a sigh of relief because retail inflation cooled down to 5.6% in July 2021. Apart from consumers, the Reserve Bank of India is also dancing this tune, because the inflation rate slipped from the central bank’s upper tolerance threshold of 6% for the first time in three months. (All’s well when ends well...

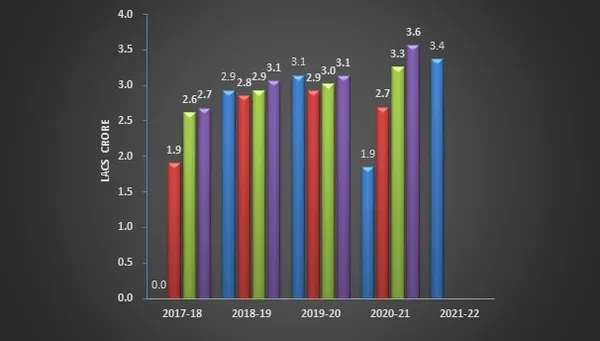

What is quarterly GST collection numbers telling investors?

The GST collection for the Q1-2021 has been phenomenal despite the second wave. We have seen highest ever first quarter GST collection despite second wave. Q1/21 GST collection was approx. 3.4 lac Crore, approx. 80% higher than Q1/20 GST collection. Q4/20-21, GST collection for the January-March quarter for the year 2020-21 was the highest crossing 3.5 Lac for the quarter. The Monthly GST collection has crossed the critical Rs.1Lac crore mark for the ninth time...

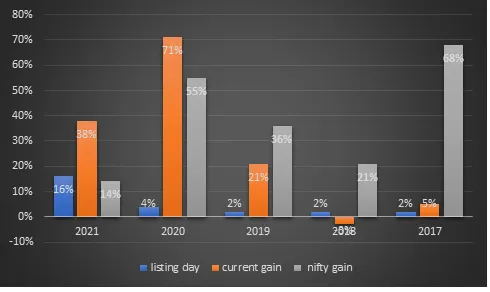

Do IPOs really make money for retail investors?

Year 2021 witnessed a surge in IPOs like Zomato, Barbeque nation, Devyani international etc. Twenty-eight companies have completed their IPO process and raised over 42,000 crore rupees in the last seven months. Thirty-four other companies are waiting for SEBI to approve their IPOs including PayTM & LIC. Other than that, fifty more companies have announced IPOs this year. In the year 2020, over 31,000 crore rupees were raised via IPOs...

Investing lessons from cricket matches

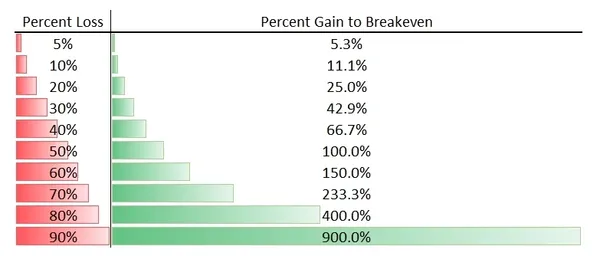

Lesson 1: Manage total team (portfolio) performance

In a cricket match, when the batting team loses too many wickets quickly, the strategy of the batsmen on the pitch is to just simply rotate the strike, take singles and keep moving...

Investing into pharma stocks…

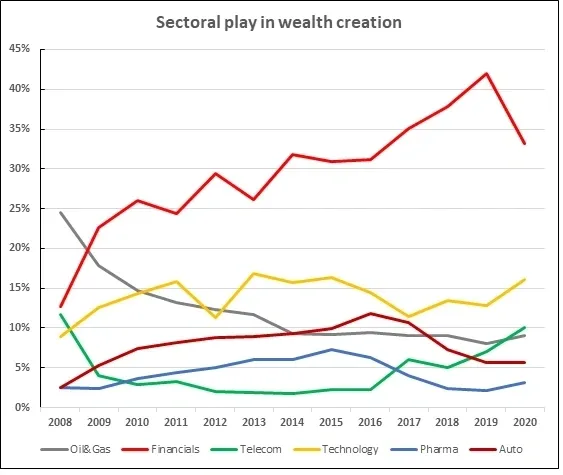

#Pharma stocks have been down up to -50% over the last 5 years & #Financials have been up +100%. However, due to recent rebound in pharma & corrections in financial sector, pharma is looking expensive and financials cheap to many investors....

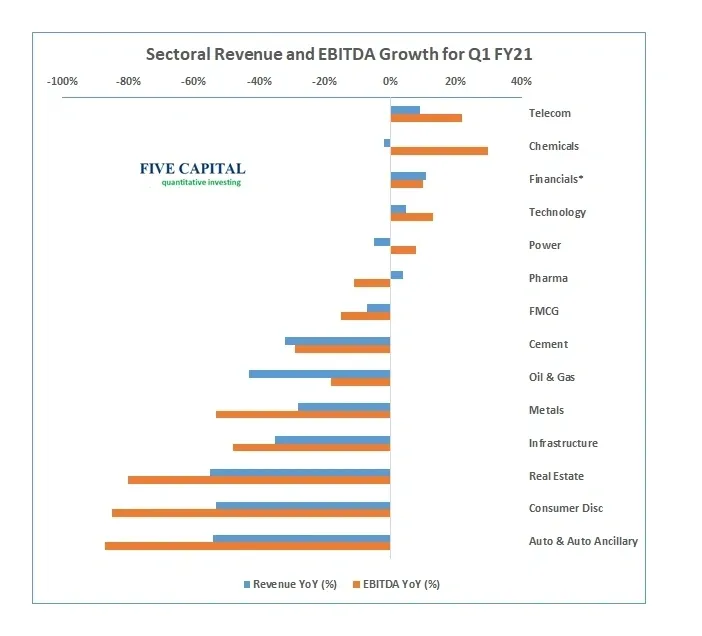

Sector Quarterly Revenue and profit growth trends

Quarterly results for most of the listed companies in India have been declared. This quarter has been an important quarter due to pandemic impact in both short and long term...

Identifying leading sectors is critical for wealth creation!!!

Being in the right sector is an integral part of wealth creation. Sectors which are in demand for various reasons attract more capital, talent and hence perform better while sectors which are going through a downturn, face difficulties in getting capital, talent, demand and hence fight for survival...

Adaptive Investing lessons from bridge Choluteca

Recently, I read a very insightful article about Bridge on the river Choluteca and the investing lessons it can teach all of us. ‘Build to Adapt’ is the new world order where technology and developments are changing lives at a dramatic speed and people/companies/industries need to adapt to thrive...

Why is the stock market rallying in a crisis-hit economy?

After the recent low for NIFTY on March 24th, 2020, the index is up over 40% as of July 17, 2020. More than 40% gain in three months, during a pandemic...

Successful career and investing need time and discipline

You started your career several years ago after your education...