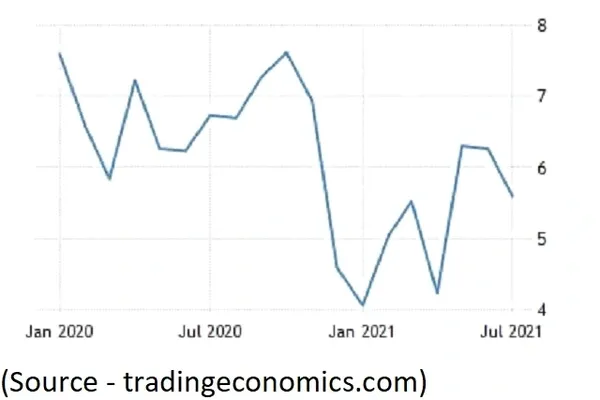

Indian consumers can breathe a sigh of relief because retail inflation cooled down to 5.6% in July 2021. Apart from consumers, the Reserve Bank of India is also dancing this tune, because the inflation rate slipped from the central bank’s upper tolerance threshold of 6% for the first time in three months. (All’s well when ends well)

It’s a piece of good news for RBI because RBI’s ability to create a monetary policy that fosters economic growth post-Covid was being questioned.

Consumer prices rose by 5.59% in July 2021 as compared to 6.26% in June 2020. The inflation figures for the month of July were- Inflation for fuel and light prices stood at 12.38%, housing prices 3.86% and for clothing and footwear prices stood at 6.46%

The slipping inflation rate is a remarkable feat because the industrial output growth halved from 28.6% in May to 13.6% in June, as the effects of the lockdown of 2020 begin to fade. All the credits for a slowed inflation rate go to reduced food items prices and easing supply-side disruptions caused due to lockdown. Apart from these government measures to balance edible oil and pulses prices also kicked in.

There was significant price tempering in inflation for vegetables, oils and fats, fruits, sugar, pulses and spices. According to the National Statistical Office (NSO) inflation estimates for July was 3.96% and 5.15% for June. The inflationary pressure will shift from goods to services as each state eases restrictions. Also, an increased demand owing to decreased restrictions will encourage producers to pass on higher input prices.

Governor Shaktikanta Das believes that the current inflationary hike was a transition. He has raised the inflationary forecast for 2021-22 to 5.7% from 5.1%. But optimism in the finance ministry believes that lifting of lockdown restrictions, supply-side policy interventions in pulses and oil seeds market and a good monsoon will bring the economy back on track (mere Karan Arjun aayenge).

Top economists disagree to characterize the recent spurt as a transitional phase because anyway inflation was projected between 5-6% range for the next three quarters. They believe that in the coming months CPI will reduce further. Any small disruption can push inflation above the 6% threshold. It all boils down to how quickly the Monetary Policy Committee begins policy normalization. Poor levels on the Index of Industrial Production (IIP) indicates that the recovery is far from over. There are miles to go when it comes to consumer non-durable production and production of capital goods. It shows that Covid-19 hurt investment prospects and big-ticket items.

The easing of retail inflation signifies normalization and recovery of the market. Dampening inflationary pressures is a good sign for investors. Be sure to make the most of it!