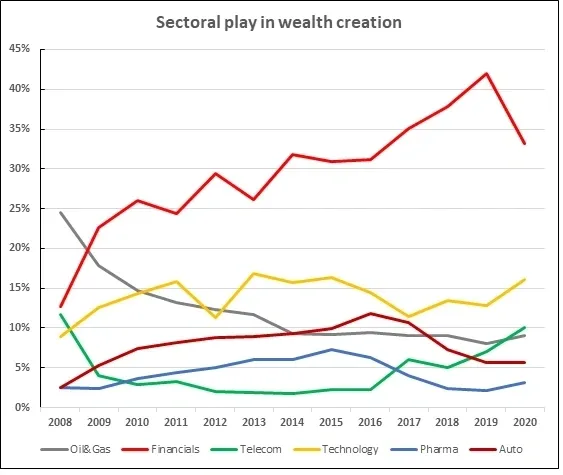

Being in the right sector is an integral part of wealth creation. Sectors which are in demand for various reasons attract more capital, talent and hence perform better while sectors which are going through a downturn, face difficulties in getting capital, talent, demand and hence fight for survival.

Between 2009 to 2015 Auto, Pharma Sectors were in demand for various reasons and hence they created significant wealth. Once tide turned against these sectors in 2015-16, pharma and auto companies struggled to create wealth till early part 2020. Pharma sector is again in demand due to current environment and should do well over 2 to 3 years.

Financial sector was the biggest wealth creator post 2008 crisis for almost 10 years. Financial sector weight increased in NIFTY from 13% in 2008 to almost 42% in 2019 where it peaked. For various reason the sector is facing the heat and now have started coming off, and ideally this financial sector downturn should continue for a few more years. It’s too early to call it a bottom.

Telecom sector which had 12% weight in 2008, lost all its sheen in the last 10 years and did significant wealth destruction. However, now for the last 1 year or so the sector is back into demand and now has everything in place for it to do well for few years.

Sector rotation is an integral feature and every 2-3 years leading sectors change and investors need to realign the portfolio. If you keep holding the sectors which are struggling, you are not in the wealth creation zone

.