Insights

Investing lessons from cricket matches

In a cricket match, when the batting team loses too many wickets quickly, the strategy of the batsmen on the pitch is to just simply rotate the strike, take singles and keep moving up the scoreboard...

Exit Plan is critical to reach destination

When you board a train to reach a destination, you know where to exit even before you board the train. Following are the 4 possibilities in your train journey towards destination...

Where are you in your wealth journey?

There are 4 kinds of investors when it comes to personal wealth journey...

Is your adviser a commission-based or fee-only financial adviser?

It is very important to know relevant regulatory registrations of your investment adviser. It is also very important to know who is paying for the advisory services you are receiving from your adviser. If you are not paying directly to your adviser, then you may be paying much more indirectly in the form of...

Are you invested into wealth creation or wealth destruction zone?

Wealth creation is a journey wherein you need to shift your investments from wealth destruction zone to wealth creation zone periodically. Nothing is static in today's investing world and hence you need to be vigilant to identify your investments...

Do you have the right exit strategy for your bad investments?

Whatever we do in life, there will be times when things won't work out as per our plan. The smart thing to do in such case would be to realign your plan with current realities and restart with vigor...

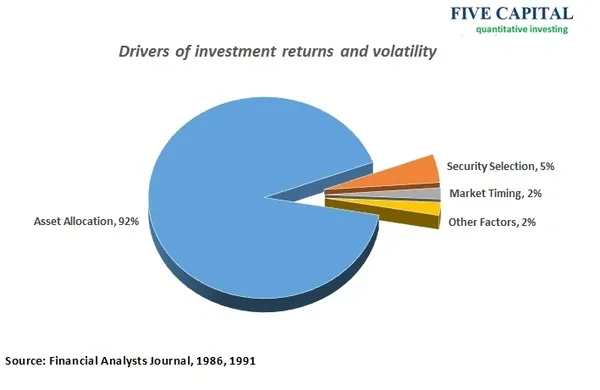

Do you have the right Asset Allocation of your investments?

Asset allocation is very different for each one of us based upon our age, current investments and liabilities, future savings, goals and risk appetite...

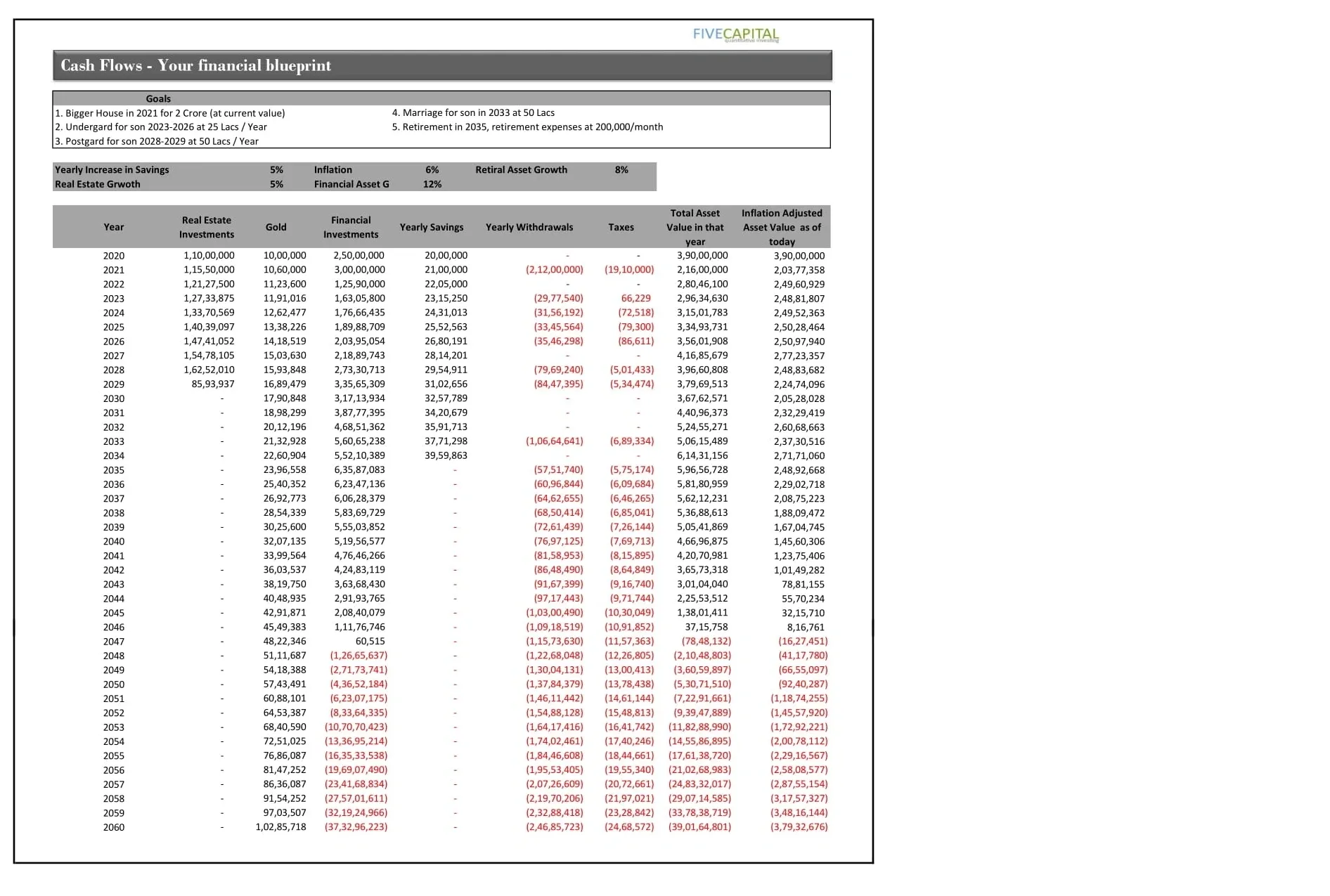

How do you know your financial net-worth in year 2030 or 2050?

Would it help if algorithms tell your financial net worth (adjusted for inflation) after 5 yrs, 10yrs, 20yrs or for any year over next 50 years, after taking into account your current and future savings, expenses, major expenses like child education, house...

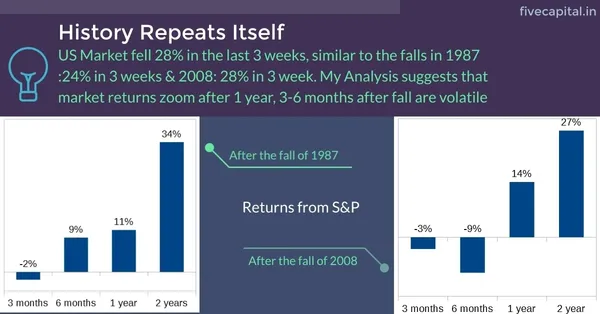

What after current stock market crash of 2020?

Indian equity markets have seen two major corrections in the last 20 years excluding the ongoing crash of 2020. We have looked into the past stock market crashes and compared them with the ongoing crash...

How to navigate from 2020 Markets crash?

After recent meltdown in global and Indian markets, the key question on everyone's mind is "what should I do, should I buy, or sell or do nothing?" We tried to dig into 100 years of S&P data and could find a lot of parallel with 1987 crash and 2008 crisis with current meltdown...

Financial Markets Meltdown – How to Handle?

US markets fell 28% in the last 3 weeks. Falls this sharp have happened only 4 times in history as per my Analysis of 100 yr of S&P...

The Only Real Way to Manage Mutual Fund Risk

When my friends & clients ask me to recommend risk-free mutual funds and I tell them 2 things: Investing is never risk free & always start investing with the golden rule of Asset Allocation...