Insights

10 financial Ravans you need to burn this Dusherra

Dusshera personifies victory of truth over the lie, good over evil. Traditionally Dusshera is celebrated by burning Ravan’s effigies hoping it takes away the evil in humanity. But that’s not it, Ravan Dahan can teach you how to burn bad habits that are stopping you from creating a life you want; financially too. So quickly let’s have a...

Where Anubhav, Viraa and Ravindra are in investing adventures

It was a happy Sunday morning. The weather was pleasantly warm, partially sunny with a cool breeze touching your skin now and then so you don’t toast yourself in the sun. Such mornings demand either a brisk jog, hiking or a nice game of football followed by pohe and doodh jalebi. But given Anubhav’s age and physique, he...

Why do many smart people LOSE money in INVESTING?

The title is a little odd as smart people usually get around. But why is it that smart people usually lose money while investing? Instead of breaking it down like a boring white paper let me tell you a story of a man named Ravindra.

What can psychotherapy teach about investing?

I bet ya’ll have heard a common saying that every event, person, experience is a teacher. It comes into your life to either give you a good experience or a great lesson. A person can learn important skills like girth, strength, perseverance or even shamelessness from a petty stone. Or he can come out as a blank slate even after...

How to invest in small-cap stocks?

Be it investing (in small, mid or large-cap stocks), starting a weight loss program, starting your own business by leaving a high-paid job (Deutsche bank) or doing something when no one believes in you requires perseverance and trust in your hunches. But all these ideas are backed by intense researches, surveys,...

Investing Adventures of Anubhav and Viraa

The traditional wisdom of investing says that investment goals differ from person to person and age to age. To understand it lets explore it with Investing adventures of Viraa and Anubhav-..

The ‘hows’ of optimizing your CAGR

Continuing with our article series on ‘Do you know the CAGR of your entire portfolio?’ let’s focus on ways to maximize the same. The previous article highlighted how behavioural biases can reduce CAGR. In this article, we will focus on a few other methods to optimize CAGR. Let's begin-

Do you know the CAGR of your entire portfolio?

Exercising with consistency is important for a healthy lifestyle. Let’s say you decide that you need to lose weight to achieve the goal of a fit lifestyle. Your weapon of choice is running. You get yourself some fancy running shoes, running gear, a tracking device etc. You even enrol yourself into some fitness program under a...

A short guide for investing in Mutual Funds

Mutual funds is a type of investment vehicle wherein an investor’s funds are combined with others investors; who have similar financial goals. The funds are invested into securities like stocks, bonds, money market instruments etc based on the investment objective of the fund. Investing in mutual funds saves time and...

Should you wait for a market correction before investing?

Investing in an all-time high market is expensive hence one should wait till the market corrects itself. These are among few policies that an investor should NOT follow. Taking that giant leap to start your investment journey in all-time highs may seem like expensive bait but you have no idea how much you can lose if you wait. It is a loss of opportunity and wealth that could have been created if you started investing early. Compounding is magic, but it needs time. To know more on how an investor can lose wealth if he invests later in life read here-

What are ESG funds? Should you think about investing in it?

In a world where social media trends, hashtags and viral videos are attracting followers, sustainable investing is picking momentum too. Given the alarming IPCC report on climate change, frequent heatwaves and irreversible effects of global warming sustainable lifestyle is not a fad anymore, but a necessity...

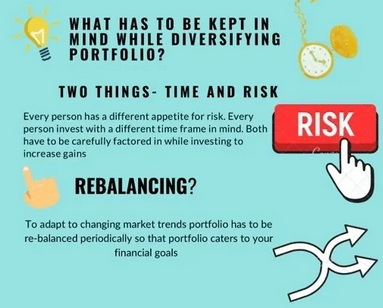

Is portfolio diversification necessary?

There is a common saying that goes with portfolio diversification that ‘don’t put all your eggs in one basket’. The idea is to minimize catastrophe by not putting all the resources in one place. But other than that, portfolio diversification means coloring the financial dreams and goals picture with 12 colors instead of four.