Should you wait for a market correction before investing?

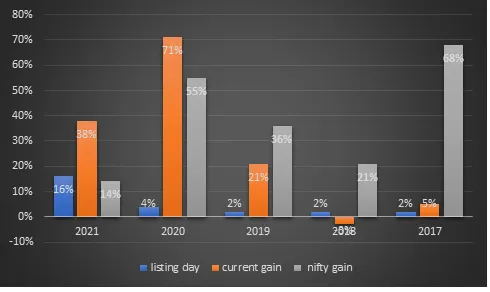

Investing in an all-time high market is expensive hence one should wait till the market corrects itself. These are among few policies that an investor should NOT follow. Taking that giant leap to start your investment journey in all-time highs may seem like expensive bait but you have no idea how much you can lose if you wait. It is a loss of opportunity and wealth that could have been created if you started investing early. Compounding is magic, but it needs time. To know more on how an investor can lose wealth if he invests later in life read here-

Should you wait for a market correction before investing? Read More »