Quarterly results for most of the listed companies in India have been declared. This quarter has been an important quarter due to pandemic impact in both short and long term.

Some sectors have done poorly due to demand contraction while some have got benefited due to restrictions in place. Some sectors have seen a temporary impact due to pandemic while for other sectors impact could be long term in nature.

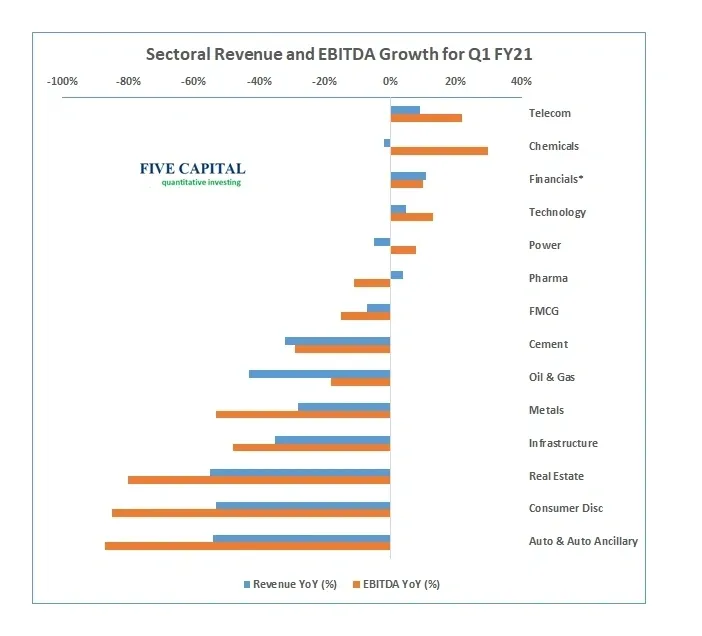

Companies in Telecom, Chemicals, Technology and Pharma sectors have declared good results. The current crisis has shifted the growth curve in the favor of these sectors. The positive impact should continue for few more quarters/years.

Companies in Financial sector, the full impact has not been seen on quarterly numbers so far due to ongoing moratorium. One has to wait for 2-3 more quarters to get complete impact on the financial sectors.

For the companies in Metals, Real Estate, Infrastructure, Hotels, Airline sectors the impact has been severe with revenue and EBITDA down significantly. In these sectors growth may take time to revive.

Every 3-5 years leading and laggard sector definition changes. Auto and Pharma sectors took lead between 2009 to 2014 followed by banks and NBFC during 2014 to 2018. As an investor, one needs to realign the portfolio with growth sectors to create wealth and come out of the sectors which are facing stress.