The GST collection for the Q1-2021 has been phenomenal despite the second wave. We have seen highest ever first quarter GST collection despite second wave. Q1/21 GST collection was approx. 3.4 lac Crore, approx. 80% higher than Q1/20 GST collection. Q4/20-21, GST collection for the January-March quarter for the year 2020-21 was the highest crossing 3.5 Lac for the quarter. The Monthly GST collection has crossed the critical Rs.1Lac crore mark for the ninth time.

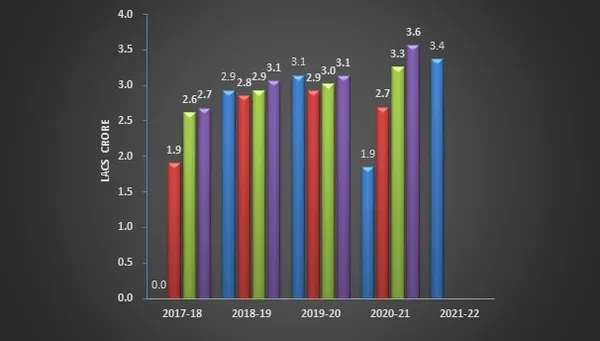

GST numbers which started with average 2.5Lacs crores in 2017-18 moved up to 3 Lac crores per quarter in 2019-20 and now jumping to almost 3.5Lacs crores quarterly in this fiscal year. This is a huge sign that economic activity is at full swing and that this decade does belong to India in terms of the GDP, economic activity and investments.

The GST collection for July was Rs. 116,393 crores. India managed to tackle the second wave and Covid appropriate behaviour allowed the economy to return to normal. Covid appropriate behaviour allowed the reopening of shops, markets, factories and operations which boosted demand for goods and services. Increased collection points out that Covid related anxieties have reduced because of rising consumption. Increasing orders and soaring business confidence lodged on the back of vaccination drive is the champion here.

The service sector is picking speed like a Road Runner, automobile sales, manufacturing activity and demand for fuel picked up too. People are returning to the pre-Covid lifestyle (everyone hated staying indoors) which has started to revive the tourism and hospitality segment. All these indicators point towards increasing economic activity; hence higher GST collection.

Higher GST collection means higher GDP growth. A higher GDP growth translates itself into a good market and better investment climate. The above analogy is as clear as a crystal!

After the tax reforms, GST eliminated the cascading tax effect. The removal of tax on tax effects will also curb inflation. GST aims to solve the confusion and unnecessary litigation issues by categorising products according to international standards. Instead of levying several taxes, only GST is levied, the hidden deadweight costs are eliminated. The reduced rate of taxation benefits every sector, which attracts foreign investment. Later on, these improvements manifest themselves into growth, which further attracts more investment.

The impact listed above translates into a single sentence called a jump in the ease of doing business index. Lo and behold! India ascended 17 positions and is ranked 63rd with a DB score of 71 by the World Bank Ease of Doing Business in 2020. The greater ease of doing business among other things is also associated with higher government tax revenues.

GST in India has five slabs and three rates – IGST, CGST and SGST. The government has hinted that the rates will be revised when Revenue Neutral Rate RNR is achieved.

GST will have a positive effect on the automobile and transportation, logistics sector, FMCG sector, consumer durables, real estate and airlines. Removal of state VATs fostered smoothening of the inter-state trade process. (smooth like butter). Many large capital funds invest heavily in companies that belong to these sectors. The stock impact of GST on every sector has positive expectations. Naturally, if every sector performs well in an economy (owing to productive reforms) increased personal income, employment generation and investments follow.

Hence the economy and the market has been coming back to normal levels at a much faster rate than anyone thought.

Be ready to take the advantage of the opportunities.