Year 2021 witnessed a surge in IPOs like Zomato, Barbeque nation, Devyani international etc. Twenty-eight companies have completed their IPO process and raised over 42,000 crore rupees in the last seven months. Thirty-four other companies are waiting for SEBI to approve their IPOs including PayTM & LIC. Other than that, fifty more companies have announced IPOs this year. In the year 2020, over 31,000 crore rupees were raised via IPOs. While everyone likes quick money, where they can see their capital getting bigger, investment market experts have at times advised against investing in IPOs.

Apart from raising capital via the market, IPOs offer liquidity for early-stage investors, early employees, or founders. Until private parties put money at discounted prices in the company, IPOs do not happen. IPOs always have multiple rounds of private investments where the prices rise each time. This is why, when stocks hit the public eye, they move higher than the start. For an IPO, companies and bankers decide the issue price rather than the market and hence it may be overrated as which promoter may like to sell its stock cheap. It also helps early investors cash out.

Therefore, your money may be used for someone else’s benefit. Also, companies have access to capital in private markets, which makes an IPO far less critical. Hype never necessarily translates itself into profit. Hype is like an emotional trap that attracts only trouble. It is always the private investors that fund the maximum capital requirements of a company, and their interests are always looked after. In 2021, 41 companies raised money via IPO. In 2020, 33 companies raised money via IPO. The figure for the same was 50 in 2019, 89 in 2018, and 90 in 2017.

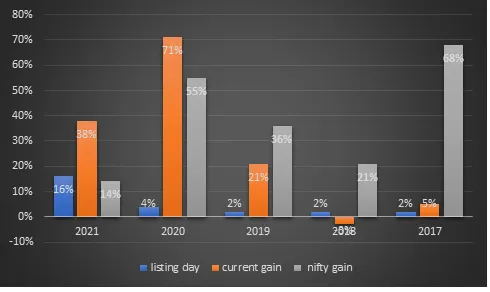

Hype creates temptation which is hard to avoid (like a free chocolate pastry); hence a retail investor needs to forgo it. After analyzing more than 300 IPOs for the last five years (2017-2021) it was noted that most IPOs start under performing after 2 years of listing.

The data and the above chart demonstrate that average IPO stock return (the orange bar) was quite lower than the nifty return (the grey bar). For the year 2018 the average current IPO gain stood at -3%, whereas the nifty return stood at 21%. Although in the year 2020 and 2021 the IPOs slightly outperformed the index because of the ongoing bull run. However it may be a matter of time before the IPO stocks start under performing again; the past data also suggest the same.

So be cautious with IPO investing frenzy and selective about IPOs, you intend to invest into. Someone forwarded a joke that “Before an IPO, the promoter has hope and investor has money; After the IPO, the promoter has money and the investor is left with the hope”. You do not want this to become an investing reality for you.