Lesson 1: Manage total team (portfolio) performance

In a cricket match, when the batting team loses too many wickets quickly, the strategy of the batsmen on the pitch is to just simply rotate the strike, take singles and keep moving up the scoreboard.Batsmen in such situations don’t try to hit all the balls nor they leave the pitch. They do what they need to do. Manage the singles and keep moving up slowly. What if they just leave the pitch as it looks difficult to win or they start hitting sixes hoping they may just get it right if they hit the ball. Would we like that?

Every team and batsman find themselves in such situations very often. They are trained to handle such situations unemotionally. The ones who become expert in managing such situations, become key players of the team for years and enjoy success, name and fame. Others who keep giving up wickets easily due to sheer pressure or risky shots, are not able to get into that “performance zone” ever.

In investing journey, every few years’ risks start increasing in our investments. At such times, we need to identify and quantify risks objectively. We need to keep moving up slowly. We shouldn’t leave investing or take unwarranted risks because of a pandemic or financial crisis. We need to slowly reduce risks if our investments have become risky and start taking long term decision one be one and soon we shall be out of the crisis. Once we do that, we will move into that “wealth creation zone”.

Lesson 2: Select the best players(stocks)

When a batsmen get out or not able to make runs, we are very prompt in giving our opinion that he is a weak player and should not be playing for team now. We do not expect a weak player to keep playing for the team unless his performance is improved.

Given a choice whom you will select for important matches, a player who is scoring 100 and consistent or a player who is inconstant and has not performed in recent times.

Now, let’s see what are we doing with our investment portfolio. What kind of stocks we are selecting for our portfolio? Are we selecting the ones which are doing well, have gone up in recent past (winners) or adding the ones which are doing bad (losers)?

If we have a collection of losing stocks, portfolio performance cannot be different. We need to select the best performers aligned with market.

Lesson 3: Let match winners (winning stocks) play more

What if captain asks the batsman who has just made 50 runs to retire in anticipation that he may get out as he has made too many runs. Does not look smart, right? Actually the ones who make 50 can only go and make 100 and so on.

Now, what we do with those stocks which are up 30% up, should we hold them to grow more or exit in anticipation that they may fall.

The ones which have done well now normally do more in future. Hold your winners.

Lesson 4: Remove under-performing players (stocks)

What If a player who gets out at quickly and we overburden him with a higher target next time and keep doing that despite his underperformance? Does it work? Not really.

It is like a player who is getting out in singles however we are increasing our expectations that he would score 50 in the next match, 100 in the 2ndmatch and so on. Does not look smart, right?

Now let’s see what are we doing with our investment portfolio. Are we removing weak stocks from our portfolio or we are adding more of them? Many investors rather add loss making stocks more in hope that it will do better.

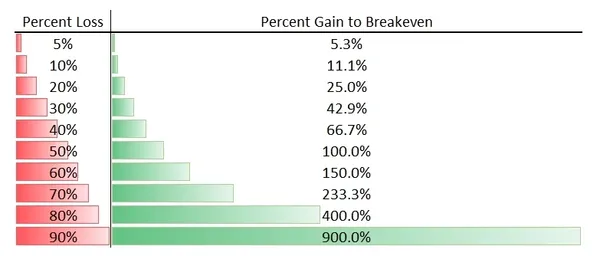

If you keep adding losers in your portfolio, you would never create wealth. Once a stock falls more than 50%, even to break-even it has to deliver 100%. Hence, we need to remove weak stocks from our portfolio quickly.

Match winners like Dhoni, Virat and Rohit are always expensive and for a reason. You are playing to win not to loose and you need match winning stocks which are doing well in current environment. Let only best stocks become and continue to be part of your investing match.