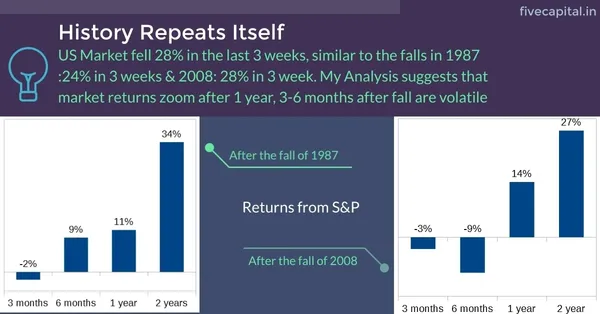

After recent meltdown in global and Indian markets, the key question on everyone’s mind is “what should I do, should I buy, or sell or do nothing?” We tried to dig into 100 years of S&P data and could find a lot of parallel with 1987 crash and 2008 crisis with current meltdown. This sell off was almost 2.5 std. deviation below mean which happened only 1% time in the last 100 years. Now, question is what happens after such meltdown. History tells us that the next 3 to 6 months are volatile, however 1-2 year returns from equities are very good. Use this opportunity to restructure your investments.